New York starts $50 million tech venture fund

The Empire State is getting into the venture capital business.

New York Gov. Andrew Cuomo announced Friday that the state will start a $50 million venture capital fund to encourage businesses working in biotechnology and advanced materials industries that have typically grown around the state’s university system.

“New York is home to some of the brightest minds in the world – and by launching this fund, we’re helping these budding entrepreneurs bring their ideas to market right here in the Empire State,” Cuomo said in a statement. “With this action, we’re continuing New York’s legacy of innovation, as well as making another solid investment in this state’s future.”

The fund is aimed at helping entrepreneurs make the transition from research to marketplace, and encouraging them to stay and grow their business within the state. This new fund will provide them with seed funding to help launch the business.

The $50 million fund is expected to use at least $100 million in private capital to support high-growth areas, including advanced materials, clean technology, life sciences and biotechnology, and information technology.

The fund will be comprised of two distinct segments. The Technology Commercialization Segment will facilitate the commercialization efforts of startup companies associated with New York’s universities and make small preseed stage investments of up to $100,000.

“There are great opportunities throughout New York State that will benefit from the additional capital and support that the new fund can provide,” Howard Morgan, a venture capitalist and member of the volunteer advisory committee, said in the release. “I am hoping that many of the top venture firms will value the added impetus that the Innovation Venture Capital Fund brings to areas that are currently under supported and have had less visibility from traditional venture sources.”

Empire State Development, a state agency, will manage the fund and will include a volunteer investment committee, an advisory group composed of experienced private investment professionals from around the state. It will also review each, and approve all, of the fund’s investments.

The Seed and Early Stage Co-Investment Segment will invest directly in seed and/or early-stage companies, with an emphasis on strategic industries such as information technology and life sciences/biotech, as well as relatively underserved areas of the state, with investments ranging from $100,000 to $5 million.

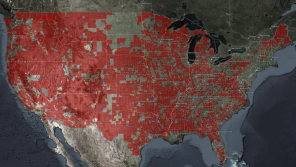

A number of other states around the country already have venture capital funds or use public funds in a way to help small businesses grow, including those that grow out of the state’s respective university system.

Texas and Maryland have similar ventures they use to help companies either grow or relocate to their state.

New York’s fund works in partnership with 64 tax-free zones across the state, tied again to the state’s public universities. While New York City and its famed Silicon Alley tech culture have gotten national attention, this initiative – indirectly – benefits primarily those outside the Big Apple, but more in the state’s less densely populated areas where these types of technology are being researched and studied.